Midas Microcredit

Microcredit Management Platform

Complete financial ecosystem for microcredit operations with fraud prevention and centralized management

Year

2024

Team

8 developers

Duration

6 months

Client

DCredito

Technologies Used

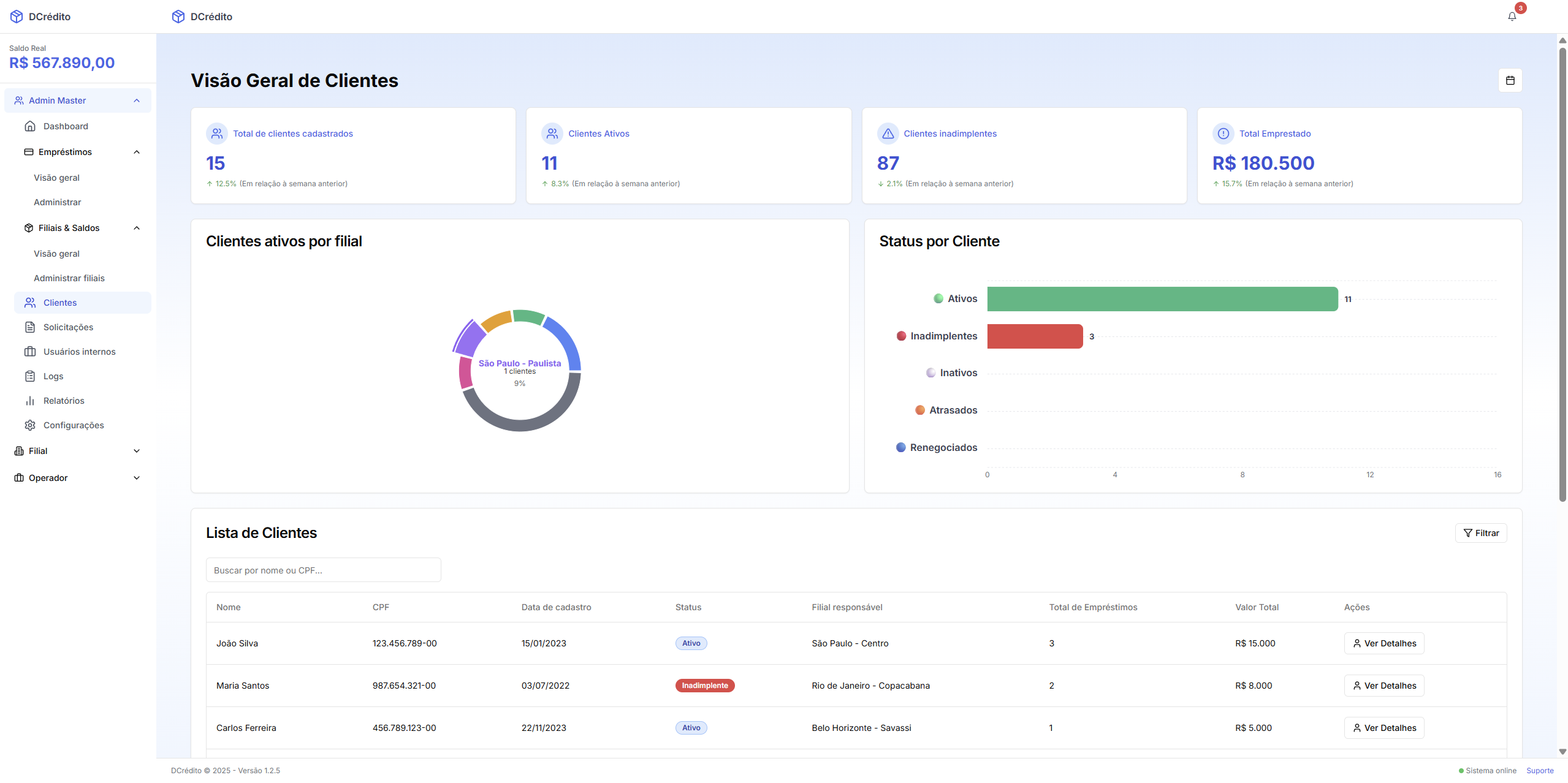

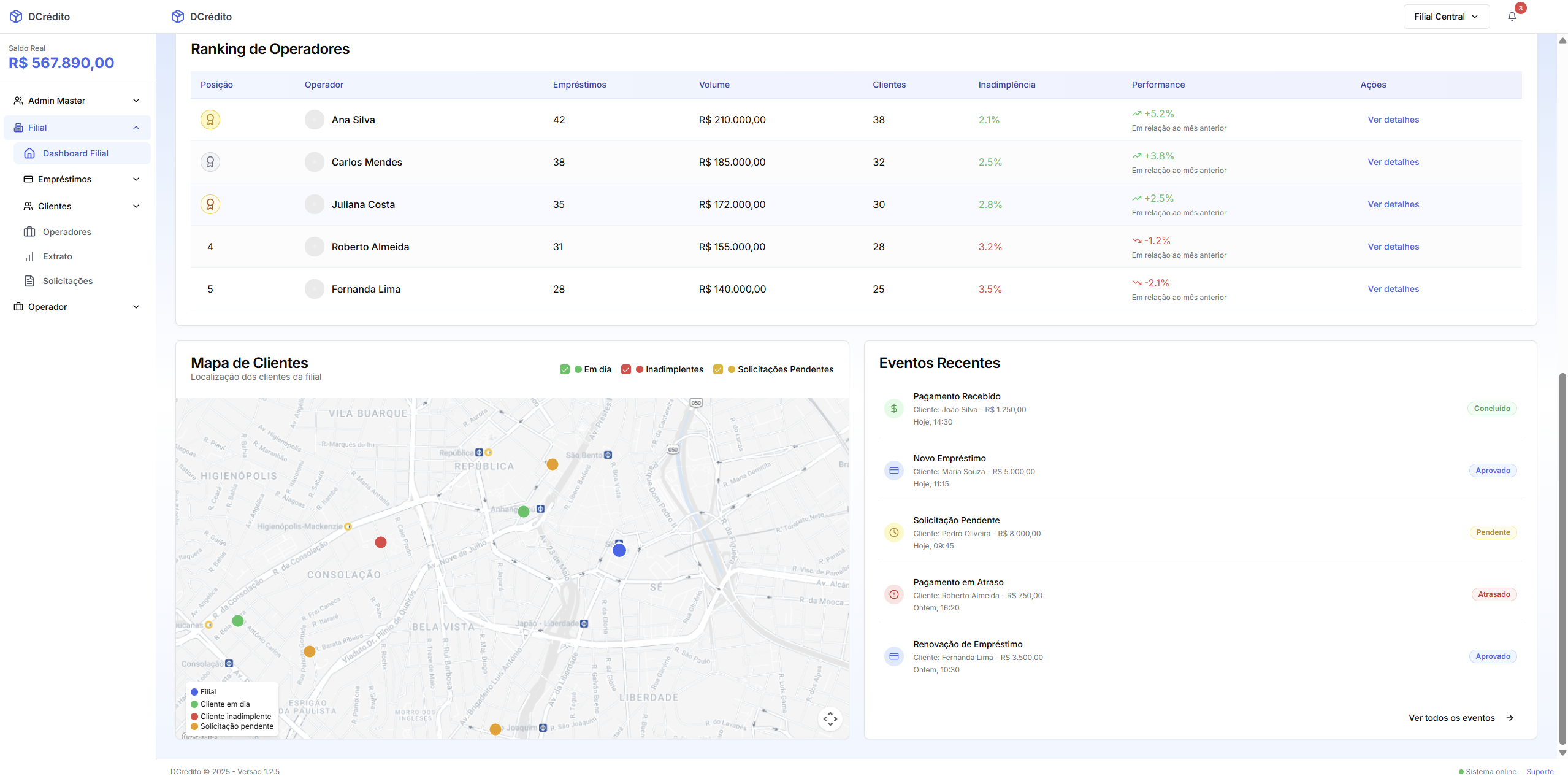

Project Overview

Understanding the challenge, crafting the solution, and delivering exceptional results.

The Challenge

DCredito suffered from constant fraud due to lack of centralized payment accounts and an infrastructure heavily dependent on trust across 700+ branches. They needed better cash flow visibility, team management efficiency, and fraud prevention while maintaining branch autonomy.

The Solution

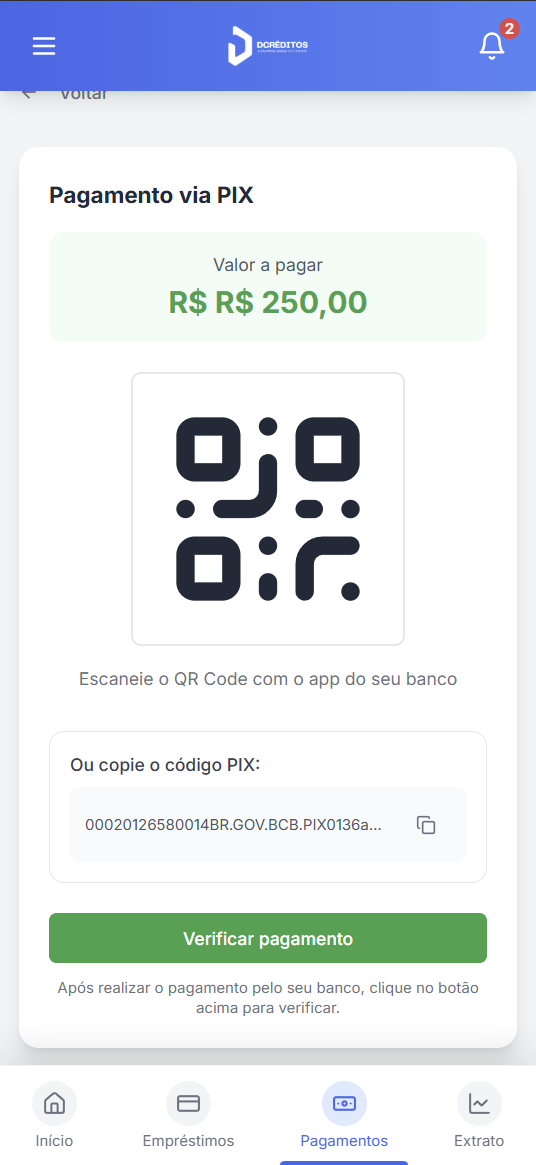

We implemented a BaaS-integrated system with virtual sub-accounts, centralized payment processing, dynamic QR code payments, and mobile apps for field operators. This created a unified ecosystem that maintained branch autonomy while providing complete operational visibility and fraud prevention.

Key Features

- Virtual sub-accounts with BaaS integration

- Centralized payment processing

- Dynamic PIX QR code payments

- Mobile app for field operators

- Real-time fraud detection

- Interactive client visit mapping

- Automated compliance reporting

- Multi-branch cash flow management

Project Overview

DCredito is one of the largest microcredit companies in Northeast Brazil with over 700 branches nationwide. Despite their size, they faced critical challenges with outdated infrastructure, cash flow management, team coordination, and fraud prevention. We developed a comprehensive financial ecosystem that revolutionized their operations through centralized account management and digital transformation.

Project Gallery

Explore the visual journey of Midas Microcredit through screenshots and key interfaces

Project Results

Measurable impact and outcomes achieved through our solution.

100% fraud reduction

fraud

+250% operational efficiency

efficiency

-60% operational costs

costs

+400% cash flow visibility

visibility